In the weeks and months leading up to the 2025 Autumn Budget, there was significant speculation around potential tax rises.

Much of this focused on Income Tax and National Insurance (NI), especially given concerns about the gap in public finances.

In its manifesto, the Government pledged not to increase Income Tax or NI, and it broadly stuck to this.

However, the Chancellor, Rachel Reeves, still confirmed a number of tax changes when she delivered the Budget on 26 November 2025. These measures are expected to raise around £22 billion in additional revenue.

Read more: Your Autumn Budget update, and what it means for you

Several of these changes could significantly affect your income, savings, or assets.

Now that the dust has settled, continue reading to learn about three of the most impactful tax changes announced in the 2025 Autumn Budget and how they might affect you.

1. Dividend Tax rates are set to rise again

If you receive passive income from dividends, changes in the Budget are likely to affect you.

Dividends are payments made to shareholders from a portion of a company’s profits. Over the past decade, both the tax-free Dividend Allowance and the rates at which dividends are taxed have shifted significantly.

Indeed, in the 2016/17 tax year, the Dividend Allowance stood at £5,000. This meant you could receive dividends up to this level without paying any tax.

Since then, the allowance has been reduced several times and now stands at £500 for the 2025/26 tax year.

As a result, a greater proportion of your dividend income is now subject to tax.

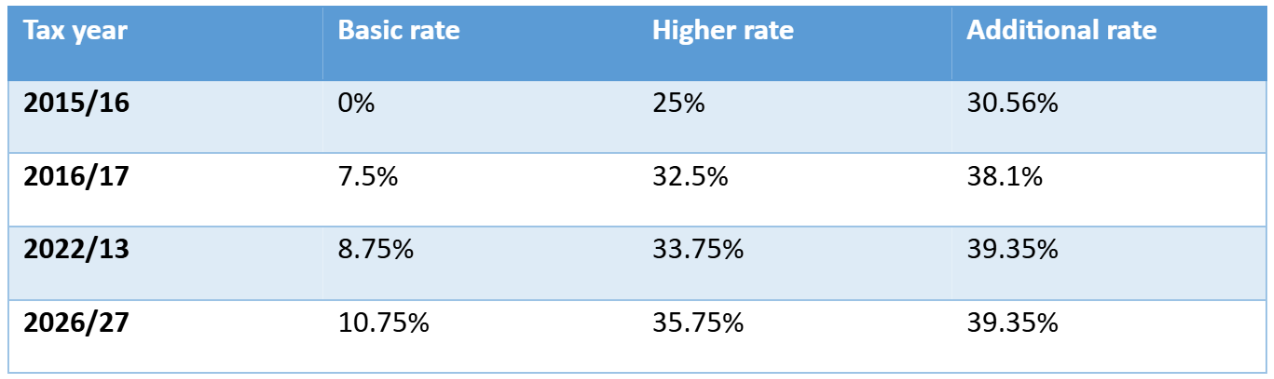

At the same time, Dividend Tax rates have also been steadily rising since 2015/16, as the table below shows:

As you can see, from April 2026, the basic rate of Dividend Tax will rise to 10.75%, while the higher rate will climb to 35.75%. Meanwhile, the additional rate has remained the same.

Over time, this change could lead to a higher-than-expected tax bill if you rely on dividends as a source of income.

As such, it might be worth reviewing how your dividend income fits within your broader financial plan, especially if you depend on it to fund your retirement.

2. A higher tax on your savings income might affect your cash holdings

The Budget also confirmed changes regarding the taxation of your savings income.

From April 2027, the rate of tax applied to your savings income will rise by 2% across all tax bands. This comes at a time when higher interest rates mean you might be more likely to exceed your Personal Savings Allowance and become liable for tax on your interest.

As well as this, changes were announced to how you can use your annual Individual Savings Account (ISA) allowance.

Indeed, for individuals under 65, of the total £20,000 allowance, £8,000 will be reserved exclusively for investments, such as company shares, leaving £12,000 for Cash ISA savings; individuals aged 65 and over may continue to hold the full £20,000 in Cash ISA savings.

These measures are likely designed to encourage you to invest over the long term, rather than hold large sums of your wealth in cash.

Read more: Why holding too much in cash could harm your progress towards your long-term goals

As such, it may be helpful to review how much you currently hold in cash, and determine whether the funds are intended to help you reach your short-, medium-, or long-term goals.

This could help ensure your savings align with your objectives while managing your tax liability.

3. Property taxes were also increased

Before the Government announced the Budget, there was speculation that landlords might face new NI charges. While this didn’t materialise, other property taxes were increased.

From April 2027, tax on property income will rise by 2% across all bands. This means you could potentially pay:

- 22% as a basic-rate taxpayer

- 42% as a higher-rate taxpayer

- 47% as an additional-rate taxpayer.

If you’re a landlord, this could mean a greater proportion of your rental income will be subject to tax, which could affect your returns once you take other costs into account.

Moreover, the Government confirmed the introduction of the High Value Council Tax Surcharge, often referred to as the “mansion tax”. This will apply to residential properties valued at £2 million or more.

The surcharge will introduce four price bands, meaning properties valued between £2 million and £2.5 million will face an additional yearly charge of £2,500.

Meanwhile, properties valued at more than £5 million will face a £7,500 annual charge.

Stick to your financial plan and avoid panicking

Following a Budget that has introduced several tax changes, it’s understandable to be concerned about any potential impacts on your finances.

However, it’s vital to remember that your bespoke financial plan is designed to account for changes in legislation over time.

In fact, while allowances and rates might shift, effective long-term planning should remain focused on your overarching goals.

If you’re still concerned, it’s worth speaking to us. We can help you stay calm by showing you how robust your plans truly are.

By allowing us to track changes in legislation so you don’t have to, you could secure some much-needed peace of mind.

To learn more about how we can support you, please use our search function to find your nearest Verso office. Or, for Verso Investment Management enquiries, please contact us at info@versoim.com or call 020 7380 3300.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All information is correct at the time of writing and is subject to change in the future.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The Financial Conduct Authority does not regulate tax planning.